Dance Against Cuts & Solidarity With the Thessalonaki 4: Two protests on Friday 14th January 2011 had little in common except that both were in part against the violence, lies and deception of the authorities, both here in the UK and in Greece.

Dance Against The Deficit Lies

Royal Exchange, Bank

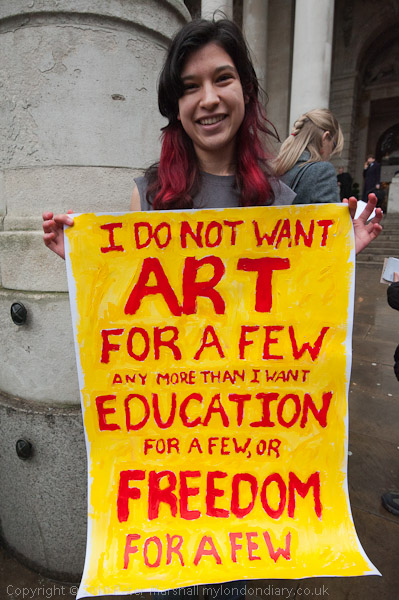

Campaigners against the savage cuts in arts and community funding by the Tory-led coalition government in the UK came to perform outside the Royal Exchange and Bank of England in a way deliberately planned to avoid confrontation with police, limiting their protest to exactly and hour and making it “playful with purpose, (so) that any aggression whatsoever (police kettles or the tiny few protesters who throw stuff) will simply look preposterous.”

The location was one “with resonances for many protesters, where some of the worst excesses of police violence and over-reaction took place at the protests against the G20, and close to where Ian Tomlinson was attacked by a police officer and died.”

At the centre of the City of London it was also appropriate for cuts that reflected the huge rescue package given to bail out the banks after their irresponsible behaviour, and to protest about their continuing excessive salaries and indecent bonuses.

It was a relatively small protest, with almost as many spectators and photographers as the hundred or so taking part, and enlivened by performances and dance rather than angry chanting. And the police for once simply stood back and watched.

The organisers pointed out that Britain is still revered for around the world, and that it brings in money to the country. “Cuts to the arts are idiotic and short sighted.” They questioned why the levy on banks was “being reduced, and why the government is not imposing measures such as the Tobin or Robin Hood tax on financial transactions that would not only being in much-needed income to reduce the deficit but would provide a beneficial stability by dampening speculation.”

Dance Against The Deficit Lies

Solidarity With the Thessalonaki 4

Greek Embassy, Holland Park

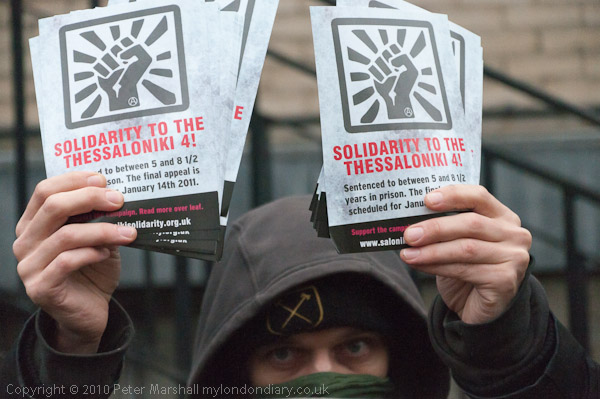

Back in June 2003, a number of protesters were arrested in a violent police attack on an anti-capitalist protest against an EU summit in Thessaloniki, Greece. They included the English anarchist, Simon Chapman, a supporter of various anarchist groups including Class War.

Seven of them, including Chapman, had later gone on hunger strike against their arrests and were finally released at the end of November 2023, following a huge solidarity campaign across Europe. Among those calling for their release were 28 EU MPs and Amnesty International. All charges against the prisoners were dropped and Simon came home to England.

Photographic and film evidence proved beyond and doubt that Chapman had been framed, charged with having three black bags containing Molotoff cocktails and dangerous weapons (a hammer and a pickaxe handle.) Photographs showed that when arrested he was carrying a blue bag, and a film clearly showed Greek police planting these black bags on him after his arrest.

But despite this the Greek state was not prepared to drop the cases, and after “repeated appeals from the Greek state prosecutor the charges against four of the original seven were re-instated.” And despite the evidence in 2008 all of these four were found guilty.

“Under the threat of a European Police Warrant … Simon was forced to return to Thessaloniki in 2010 to appeal the conviction.” But this time the evidence resulted in all the major charges being thrown out, with all four instead being found guilty of a “minor defiance of authority” to justify the time they had previously spent in jail. And Chapman came back to England and Class War.

But the Greek experience had scarred Chapman and he never really recovered from being arrested and his treatment in prison, and the health effects of the lengthy hunger strike, dying at only 40 in 2017.

Class War came to the May Day march that year at Clerkenwell Green with a new banner in his memory, and also copies of a new Class War newspaper to sell. When the march set off for Trafalgar Square they “marched only the few yards back to the pub, where I joined them later” to celebrate Simon’s life.

Solidarity With the Thessalonaki 4

Flickr – Facebook – My London Diary – Hull Photos – Lea Valley – Paris

London’s Industrial Heritage – London Photos

All photographs on this page are copyright © Peter Marshall.

Contact me to buy prints or licence to reproduce.