TUC ‘March For The Alternative – On 26th March 2011 between a quarter and half a million people marched through London against planned public spending cuts by the Conservative-Liberal Democrat coalition government in the largest demonstration since the 2003 protest against the plan to invade Iraq.

The TUC argued that what the country needed was not austerity but policies that would grow the economy, and that we should raise income from those more able to pay rather than by measures that had the greatest impact on the poorest in society.

It was the largest march and rally organised by the trade union movement since the Second World War, and like other major trade union marches was perhaps largely worthy but not exciting – and like others it achieved nothing. The cuts went ahead and we all suffered – except of course the wealthy – who continued to grow richer and richer, helped by government bail-outs and the deliberate failures to tackle tax evasion, stop tax avoidance loopholes and raise taxes on those with excessive wealth.

The cuts particularly hit the public services, including teachers, nurses and other medical professionals – and eventually helped drive these areas into the critical conditions that they are now in. They resulted in financial problems and excessive workloads and also meant that those of us who rely on public provision for health and education often failing to get proper treatment. The gap between those who could afford private services and those who relied on the state provision increased.

Particularly hard hit by the cuts were the disabled and for them the situation continues to worsen with our now Labour government announcing huge cuts which will leave many considerably worse off – and greatly reduce their ability to lead normal lives and contribute to society.

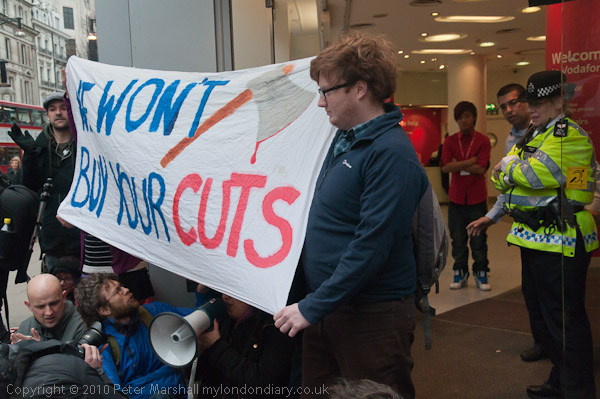

As well as the TUC, other groups contributed to the march, announcing various feeder marches and other activities, many of which added a little life and colour to the day’s events. They also resulted in over 200 arrests and a number of injuries.

Too much was happening on the day for me to rehash it all here, but you can read my seven posts on my London Diary for my account of events. I started with the feeder marches from South London, disowned by the TUC. The ‘Armed Wing of the TUC’ brought its street theatre Trojan Horse, Spitfire, Tank and armed Lollipop Ladies produced by Camberwell art students to Camberwell Green where they marched to Kennington where the South London Feeeder March was gathering for a rally before the march in Kennington Park – the site of the final “monster meeting” of the Chartists on 10th April 1848 from where they marched to Parliament to deliver their final petition.

I left there to take the tube to Trafalgar Square where I found that the main march had started early and was well on its way to Hyde Park and I stayed around there for over an hour as marchers filed past, including photographing the Morris Liberation Front, an idea of Henry Flitton specially for the TUC demonstration, with music, provided by a couple of mandolins playing the Clash’s ‘I fought the Law’ and the Smith’s ‘Panic.

Later in the day Trafalgar Square was the site of bitter fighting as police made a largely unprovoked attack on a partying crowd, but when I was there things were peaceful.

I left the square to follow several hundred anarchists, dressed in black and mainly wearing face masks making their way up past the National Portrait Gallery, many waving red and black flags. I went with them through the back streets to Piccadilly Circus and then up Regent Street where they turned off into Mayfair and were held off by police when they attacked a RBS branch – one of the main banks to receive a huge government handout.

At Oxford Circus they attacked Topshop, then owned by the prominent tax avoider Sir Philip Green. As I went to take photographs of police arresting one of the protesters and holding him on the ground I was “hit full on the chest by a paint-bomb possibly aimed at the police, although many of the protesters also have an irrational fear of photographers. My cameras were still working and I continued to photograph, but I had also become a subject for the other photographers.”

It wasn’t painful, but it was very messy and bright yellow. I scraped and washed the worst off in a nearby public toilet for around 20 minutes, then went out to take more photographs, joining UK Uncut supporters who had come to hold peaceful protests at tax dodging shops and banks around Oxford St and to party at Oxford Circus.

Eventually I followed them down to Piccadilly Circus where 4 hours after the start of the official march people were still filing past. I stopped there and photographed until the end of the march passed, rather than going with UK Uncut into Fortnum and Mason. Inside the story they sat down and occupied the store peacefully. if noisily calling on them to pay their taxes. After an hour or more a senior police officer told them they were free to leave, promising they could make their way home “without obstruction”. 138 were arrested as they left the store, charged with ‘aggravated trespass’. Most of the cases were latter dropped but at least 10 were found guilty, given a six-month conditional discharge and a £1,000 fine.

Even after the official end of the march there were various other groups following the march route – including a group of Libyans with green flags, marching in support of Colonel Gaddaffi. I walked back to Trafalgar Square where there were still plenty of people around but everything was pretty quiet, so I got on the tube to come home and try to wash more of the paint off.

I think it was later when police made a charge to try and clear Trafalgar Square than almost all the arrests on the actual march took place – according to Google “Further clashes were reported later in Trafalgar Square. 201 people were arrested, and 66 were injured, including 31 police officers.” Had the police simply gone away people would have eventually dispersed and there would have been no trouble.

Back home I spent hours trying to scrub out yellow paint, but the rather expensive jacket I was wearing was only ever really fit to wear for gardening. The also expensive jumper underneath still has some small traces of yellow 14 years and many washes later, though I do sometimes still wear it around the house. Until my Nikon D700 came to the end of its life, beyond economic repair, a few years later I would still come across the occasional speck of yellow paint.

Much more about the day and many more pictures in the following posts on My London Diary

26March: Armed Wing of the TUC

26March: South London Feeder March

26March: TUC March – Midday

26March: Dancing in Trafalgar Square

26March: Black Bloc Goes To Oxford St

26March: UK Uncut Party & Protest

26March: The End of the TUC March

Flickr – Facebook – My London Diary – Hull Photos – Lea Valley – Paris

London’s Industrial Heritage – London Photos

All photographs on this page are copyright © Peter Marshall.

Contact me to buy prints or licence to reproduce.